20 Reasons Why VBC Deals Fail in Practice — And How To Solve Them

Better healthcare at lower costs is what we all want. In theory, value-based care (VBC) arrangements should achieve this objective. However, in reality, most of these initiatives do not achieve their full potential. The reasons for their failure can be categorized as follows:

-

Contract design issues

-

Information asymmetry

-

Mechanical mistakes

-

Execution gaps

-

Financial gamesmanship

We explore these categories and discuss tactics to mitigate them below.

Contract Design Issues

Contract Design Issues

Outcomes in VBC hinge on both actual performance and measurement accuracy. Many deals falter because contracts are not actuarially sound or fail to account for natural utilization patterns. Common pitfalls in this category include:

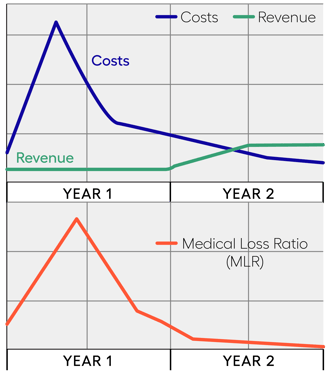

1. Mean Reversion Bias: Patients often cost more just before attribution (e.g., at diagnosis) and less afterward. Without actuarial modeling that accounts for this trajectory, contracts can be structurally biased. In high cost disease-focused value-based care models, costs frequently spike at diagnosis (often tied to an admission/event related to initial diagnosis/hitting attribution rules) and then fall to a lower maintenance level, while revenue (in MA deals) from the diagnosis lags until the following year. Medical loss ratios can swing from ~200% pre-attribution, to ~100% in the diagnosis year, and down to ~70% the following year. If contracts don’t account for this trajectory, performance results will be skewed.

In high cost disease-focused value-based care models, costs frequently spike at diagnosis (often tied to an admission/event related to initial diagnosis/hitting attribution rules) and then fall to a lower maintenance level, while revenue (in MA deals) from the diagnosis lags until the following year. Medical loss ratios can swing from ~200% pre-attribution, to ~100% in the diagnosis year, and down to ~70% the following year. If contracts don’t account for this trajectory, performance results will be skewed.2. Attribution Ambiguity: Lack of clear definitions around how attribution works. Service dates, paid dates, triggering events, and member inclusion/exclusion rules must all be clearly defined for accurate attribution.

3. Financial Definition Gaps: Unclear financial definitions create measurement error. Contracts must specify claim inclusion/exclusion rules and define financial variables (e.g., paid vs. allowed amounts, MLR, rebates, subsidies, reinsurance) to ensure accuracy.

4. Policy Shifts: Changes in cost-sharing, regulations, or plan strategies (e.g., impacts from the Inflation Reduction Act, Star ratings, CMS bids) can materially alter financial liabilities and revenues over time.

5. Trend: Prospective, and even retrospective, medical trend estimates are often inaccurate, introducing bias and measurement error that can skew results.

6. Reconciliation Timelines: Contracts must clearly define reconciliation timelines—including service, payment, and settlement dates, plus IBNR treatment—because misaligned timing or inconsistent data can distort comparisons between baseline analysis and final financial results.

7. Quality Multiplier Inconsistencies: Quality multipliers are subject to the same risks as overall financial calculations; their methodology, underlying data, and timelines should be clearly defined to avoid errors.

What You Can Do About It:

Ensure contracts explicitly define attribution, financial variables, trend, reconciliation rules, and quality measures. Use actuarial modeling to account for natural cost and revenue patterns. The goal is to make contracts both fair and operationally executable.

Information Asymmetry

Success in VBC depends not just on well-designed contracts, but also on timely, actionable, and complete data. Many deals struggle because delays, limited actionability, or missing data make it difficult to understand performance and take corrective steps. Key challenges include:

8. Information Lag: Significant delays in performance results make it difficult to assess the impact of program initiatives or accurately track and reserve for financial outcomes.9. Actionability: Financial results are sometimes not linked to specific, actionable steps that can improve performance. Without this connection, value-based care initiatives cannot drive meaningful change.

10. Data Gaps: Providers may lack access to claims, eligibility, and revenue data necessary to monitor program performance. Missing data amplifies the challenges of lag and limited actionability.

What You Can Do About It:

Prioritize timely access to comprehensive data and connect performance metrics to actionable steps. Introduce contract requirements for the exchange of necessary claims, eligibility, and revenue data. Establish feedback loops so teams can learn from results and make incremental improvements. At Arbital, we’ve focused on optimizing the integration of disparate data sources and automating reporting to reduce lag, improve visibility, and ensure teams can act on accurate, real-time insights that tie back to contract performance.

Mechanical Mistakes

Mechanical Mistakes

Even well-designed contracts can produce inaccurate results if calculations and data handling are flawed. Common sources of mechanical errors include:

11. Data Pull Issues: Incorrect or incomplete data pulls can affect target price setting, reporting, and financial settlements.12. Overlapping Attribution: For Payers with multiple VBC deals, handling members attributed across deals can be complex and may create cross-deal implications.

13. Spreadsheet Errors: Using spreadsheets for VBC reporting and settlements can introduce minor mechanical mistakes that compound into material calculation errors.

14. Incorrect Application of Contract Rules: Even with clearly defined contract calculations, errors can occur in execution. All calculations should be reviewed by personnel with the appropriate skill sets to ensure accuracy.

What You Can Do About It:

Implement rigorous data validation, standardized calculation procedures, and peer review to catch errors early. Reduce reliance on spreadsheets by centralizing calculations and automating repetitive processes. At Arbital, we’ve focused on building automated adjudication workflows that enforce contract rules consistently, minimizing human error while making complex calculations auditable and reliable.

Execution Gaps

Execution Gaps

Even with sound contracts and accurate data, performance can suffer if execution is misaligned. Common challenges include:

15. Lack of Meaningful KPIs: Key Performance Indicators should directly reflect the outcomes defined in the contract.16. Focus on the Wrong Metrics: Pursuing too many metrics—or ones that don’t impact contracted outcomes—dilutes effort and fails to improve contract value or financial performance.

17. Missing Feedback Loops: Delays in data and reporting often prevent teams from learning and applying incremental process improvements to optimize contract performance.

What You Can Do About It:

Align KPIs and metrics directly with contract outcomes to focus effort where it matters. Avoid tracking measures that don’t impact financial or clinical performance. Establish clear feedback loops so teams can adjust tactics quickly in response to real results. Automation and real-time dashboards can make monitoring and action more efficient and effective.

Financial Gamesmanship

Financial Gamesmanship

Value-based care can break down when participants prioritize negotiation or “winning” over accurate measurement and collaboration. Common pitfalls include:

18. Negotiating Instead of Measuring: Business leaders may treat financial settlement as an opportunity to negotiate outcomes rather than simply measure results according to the contract.19. Chasing Financial Outcomes Instead of the Truth: Focusing on hitting specific financial targets rather than reflecting actual performance undermines the integrity of the agreement.

20. Viewing VBC as a Zero-Sum Game: Treating VBC as “us vs. them” is counterproductive. Value-based care is designed to support the Triple Aim: better care for members, healthier populations, and lower costs. Participants with a zero-sum mindset hinder progress and should reconsider their approach.

What You Can Do About It:

Promote a culture of transparency and measurement-first decision making. Ensure settlements follow contract rules and verified data, not negotiation tactics. Encourage collaboration between parties in both the contracting phase but also a monitoring phase to avoid “us vs. them” dynamics, and consider leveraging platforms that provide auditable, objective calculations to maintain trust and integrity between parties.

Conclusion

VBC deals don’t fail because the concept is flawed—they fail due to execution challenges. Building clear contracts, ensuring accurate reconciliation, and surfacing actionable insights are critical to success. Tools like Arbital’s Platform can support these efforts by providing actuarial expertise, centralized data, and automated workflows that help payers and providers focus on improving outcomes rather than managing spreadsheets.

Reach out today to discuss how we can support your organization!

We’re ready to help you stay ahead.